Table of Contents

- Qualcomm Stock Is a More Solid Trade With This Pairing | InvestorPlace

- AVGO: Is Broadcom (AVGO) a Software Stock Buy for October?

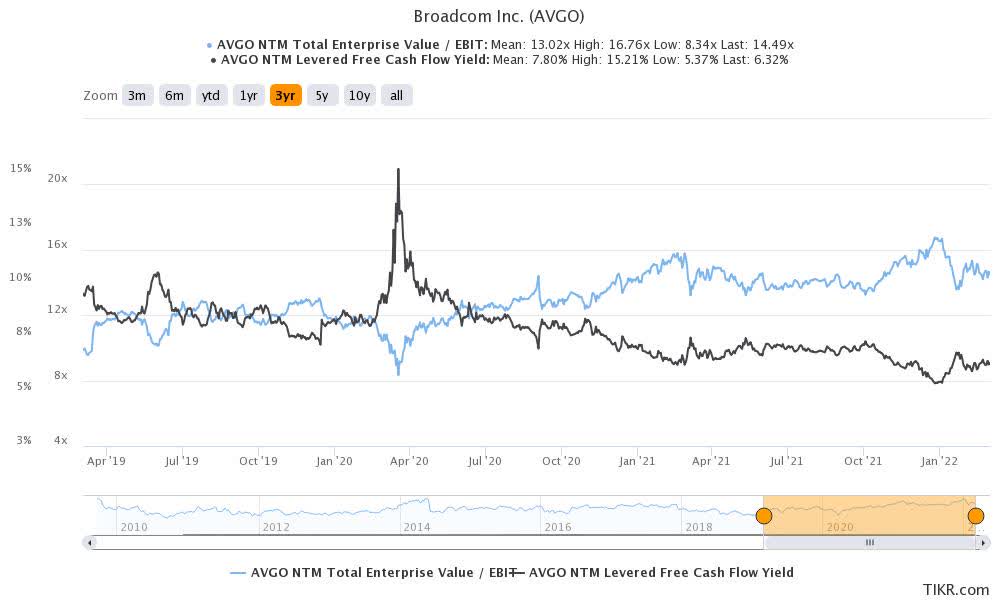

- Buy Broadcom While You Can (NASDAQ:AVGO) | Seeking Alpha

- AVGO: 3 Tech Stocks to Buy on a Market Pullback

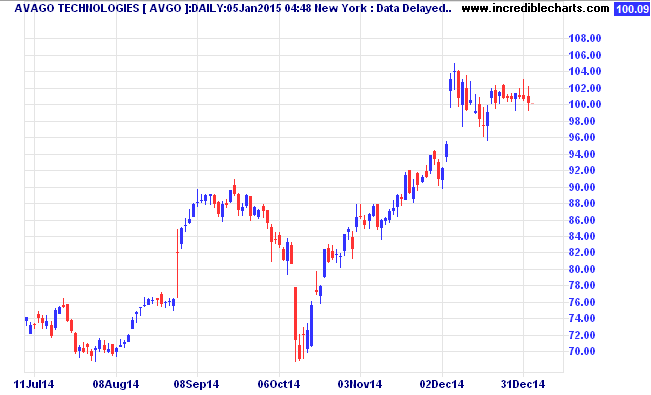

- Avago AVGO Stock Report « Stock Universe - Investing Blog and Tech ...

- AVGO Stock Price and Chart — NASDAQ:AVGO — TradingView

- AVGO Stock Price and Chart — TradingView

- AVGO Stock: Broadcom Nears Buy Point On AI Chip Growth | Investor's ...

- AVGO Stock Forecast & Price Prediction - What's Next for Broadcom Stock ...

- AVGO Stock Price and Chart — NASDAQ:AVGO — TradingView

About Broadcom (AVGO)

New Buy Rating: A Vote of Confidence

Key Drivers of Growth

Several factors are driving Broadcom's growth and contributing to its strong financial performance. Some of the key drivers include: Increasing Demand for Semiconductor Solutions: The growing demand for semiconductor solutions in various industries, including wireless communication, automotive, and industrial, is driving Broadcom's revenue growth. Expanding Product Portfolio: The company's diverse product portfolio, which includes a wide range of semiconductor and infrastructure software solutions, is helping to attract new customers and increase sales. Strategic Acquisitions: Broadcom's strategic acquisitions, such as its purchase of CA Technologies, have expanded its product offerings and strengthened its position in the market.

Future Prospects

The new buy rating and the company's strong financial performance have set the stage for a promising future. With its solid revenue growth, expanding profit margins, and promising outlook, Broadcom is well-positioned to continue its upward trajectory. The company's commitment to innovation and its focus on emerging technologies, such as 5G and artificial intelligence, are expected to drive growth and increase its market share. The new buy rating assigned to Broadcom (AVGO) is a significant development that reflects the company's strong financial performance and growth prospects. With its solid revenue growth, expanding product portfolio, and promising outlook, the company is well-positioned to continue its upward trajectory. As the technology sector continues to evolve, Broadcom is expected to play a key role in shaping the future of semiconductor and infrastructure software solutions. Investors looking to capitalize on the growth of the technology sector may want to consider adding Broadcom to their portfolio.Keyword: Broadcom (AVGO), technology giant, new buy rating, semiconductor solutions, infrastructure software solutions, growth prospects, investment, stock market.